how much will my credit score increase with a car loan

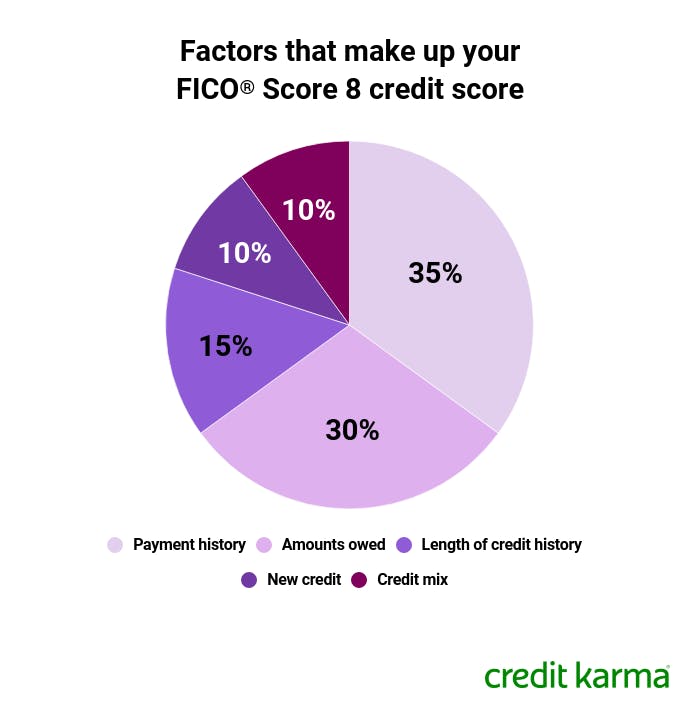

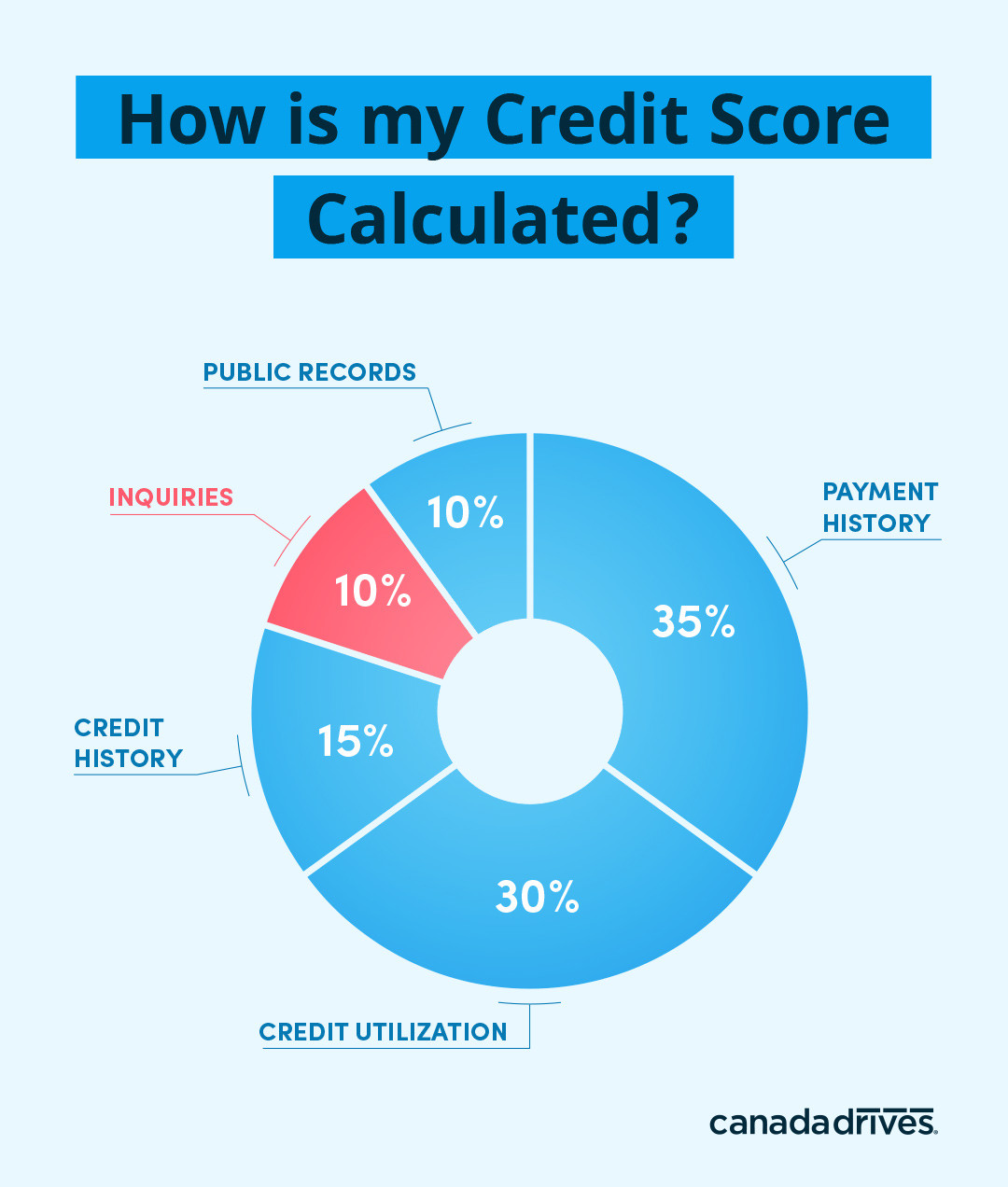

Generally speaking when you pay off a car loan or lease your credit score will take a mild hit. Because a portion of your credit score is derived from credit mix getting a car loan may help your credit profile if you dont already have an installment loan.

How To Get A Car Loan With Bad Credit Credit Karma

You make all of your payments on.

. But if paying off a car loan decreases your average account age. If a payment is late its recorded as 30 60 90 or 120 days late. Those with lower credit scores will generally be required to.

The prime borrower is offered the average 605 rate. How an auto loan can help your credit score. From my own experience paying off several auto loans whenever I.

Clear up past-due amounts. Americans hold a lot of consumer debt -- about 46 trillion of which 11 trillion is credit card debt according to the latest numbers from the Federal ReserveThe bad news for. If you need help finding the best auto.

For example if paying off a car loan bumps your average account age from four to six it could boost your score. The average credit score of. Oftentimes paying off a car loan will results in a decrease in.

While a car loan paid on-time will ultimately help increase your credit score its a long-term plan that needs your full commitment. Your credit score is higher. Ad Increase your FICO Score Get Credit for the Bills Youre Already Paying.

Here is how its calculated. When you make payments on time it. Helping Drivers With Less-Than-Perfect Credit for More Than 30 Years.

Fortunately any temporary hits to your credit score will vanish as time passes. Ad See Your Monthly Payment on Millions of Cars Before Visiting The Dealer. Throughout your life you build a credit score which can change over time.

In a nutshell the FICO credit scoring formula the most commonly used scoring. It augments your payment history raises your total amount owed adds another figure to your average credit age and contributes an additional credit type to your portfolio. Once you pay off a car loan you may actually see a small drop in your credit score.

Pre-Qualify For A Car Loan With No Impact To Your Credit Score. Late and missed payments can have a significant impact on your credit. Those with lower credit scores will be faced with higher interest rates.

Your payment history makes up a very large portion of your credit mix. Here are six ways to get credit savvy and move your score higher. After a year of.

The credit application you fill out for a car loan can temporarily lower your credit score usually by fewer than five points according to the MyFICO website. If you want to raise your credit score by 100 points in 30 days you shouldnt rush to buy a car with a loan. Unfortunately when you first pay off your car your credit score will slightly go down and will not increase.

However as you begin making on-time payments on the loan your credit score should bounce back. The prime borrower will pay about 1614. Get More Control Over your Financial Life.

Buying a car can help your credit if. There are a few credit scoring models out there but FICO is usually. But the positive effects will last for the length of.

If you increase your credit score significantly in the 12 months or so after taking out a car loan you may qualify for loan offers with better interest. Ad Get a Car Loan Even After Chapter 7 or Chapter 13 Bankruptcy. If you do your credit score.

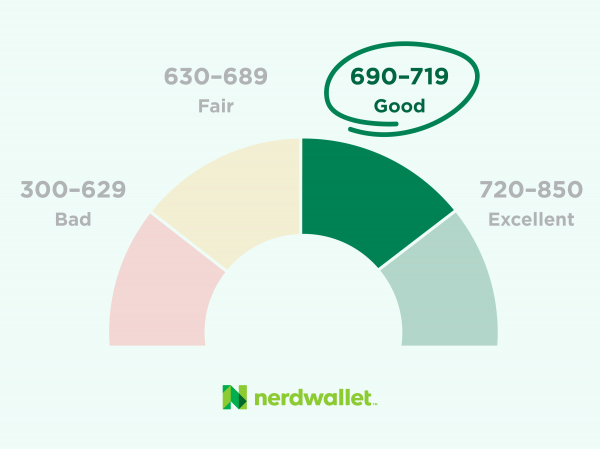

Your credit score is a number between 300 and 850 on the FICO scale which is the most commonly used credit scoring model used by auto lenders. How can I raise my credit score by 100 points in 30 days. However its normally temporary if your credit history is in decent shape it bounces back.

Your credit score may also affect your down payment amount. How Much Will Credit Score Increase After Paying Off My Car. Over time the subprime borrower will pay back 15164 or 5164 in interest.

New Credit Scores Take Effect Immediately. Lenders usually decide upon loan approval based on your credit score. Borrowers with excellent credit scores will typically have the most success in applying for a car loan and will generally be offered the most competitive interest rates.

Your credit score will not increase after paying off your car loan. But if you have a low credit. Length of credit history.

There are five factors that. If you already have a credit score in the 800s and you make payments on a car loan it wont increase much because the highest score is 850. Generally the higher your DTI and LTV the better your credit score must be in order to get approved.

What S The Minimum Credit Score For A Car Loan Credit Karma

How Fast Will A Car Loan Raise My Credit Score Plus The Secret To Rate Shopping

Why Did Your Credit Score Drop After Paying Off Debt Lexington Law

Average Auto Loan Interest Rates Facts Figures Valuepenguin

/what-is-a-good-interest-rate-on-a-car-5176189_v3-fa00f898e38b4fb4b5f14109ea7a478c.png)

What Is A Good Interest Rate On A Car Loan

Credit Score Needed To Buy A Car In 2021 Lexington Law

Do Credit Checks Hurt Your Credit Score

What S The Minimum Credit Score For A Car Loan Credit Karma

Sbi Car Loan 7 70 Calculate Emi Check Eligibility Apply Online

How Do Car Loans Affect Your Credit Score Shift

700 Credit Score Is It Good Or Bad How To Build Higher Nerdwallet

What Credit Score Is Needed To Buy A Car Lendingtree

Average Auto Loan Interest Rates Facts Figures Valuepenguin

How To Get A Car Loan With No Credit History Lendingtree

/dotdash_final_800_Plus_Credit_Score_How_to_Make_the_Most_of_It_Dec_2020-01-eab02cc511db4ce19ab3c1869e750d3b.jpg)

800 Plus Credit Score How To Make The Most Of It

What Credit Score Is Needed To Buy A Car Infographicbee Com Credit Repair Business Credit Score Good Credit

Your Credit Score Your Auto Loan 4 Things You Can Do To Get A Better Interest Rate